Argonaut Reports Record Results in FY25

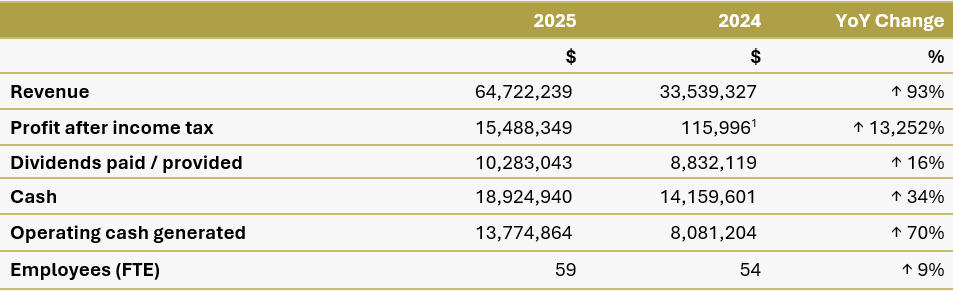

Argonaut is pleased to announce record Revenue and Profit after Income Tax of $64.7 million and $15.5 million respectively for the financial year ended 30 June 2025 (FY25).

The exceptional financial and operational results were achieved across the full-service Argonaut platform.

Equity Capital Markets (ECM) activity remained robust, with $1.7 billion raised for clients, alongside several milestone M&A transactions. Brokerage revenues lifted significantly (up 60% year-on-year) and the corporate finance division achieved a 41% increase in attributable fees. Argonaut’s Funds Management division delivered strong outperformance relative to respective benchmarks with the Global Gold Fund up 51.2% and the Natural Resources Fund returning +14.7% net of fees. Finally, the firm’s ongoing commitment to market leading, institutional research resulted in the coverage universe increasing to a combined market capitalisation of $175 billion by year end.

These record results reflect the strength of Argonaut’s differentiated business model, talent-led growth strategy and the continued successful outcomes achieved alongside clients amid supportive market conditions.

A summary of the 2025 financial results are as follows:

Commenting on the FY25 results, Executive Chairman, Head of ECM & Principal Investments Eddie Rigg said:

“FY25 was a breakout year for Argonaut. While many firms are focused on wealth management, we are dedicated to wealth creation through the execution of high-quality transactions. We are proud of our lean, high-performing team that consistently delivers outcomes benefiting both our corporate and investing clients. Our repeat business is a testament to the trust we’ve built and the success we continue to share with our clients.”

Chief Executive Officer and Head of Corporate Finance Greg Southee added:

“FY25 showcased what’s possible with a focused strategy and an exceptional team. Our people are the engine of Argonaut’s success and this year’s results reflect their ability to consistently deliver value to our clients across all divisions of our business. Our key hires, refreshed branding and new office premises highlight the continuing strategy of firm-wide investment to further strengthen our operating platform for clients and staff alike.”

In FY25, Argonaut made strategic investments in talent including the senior appointment of Digby Gilmour as Managing Director, Head of Institutional Sales and Anthony Bayne as Managing Director M&A, Corporate Finance.

The firm unveiled a refreshed brand and website in September 2025, marking a new chapter in its growth journey. Argonaut also recently relocated to its new Greenstar 6-certified headquarters at Level 16, 9 The Esplanade, Elizabeth Quay, a state-of-the-art facility designed to support future expansion.

Argonaut’s strategic 27% investment in Salubris Australia Limited, treated as an associate under IFRS, continues to progress. Salubris acquired its second carbon regeneration project during FY25 and is actively advancing additional opportunities, including biodiversity initiatives in FY26. Salubris is seeking to be the largest independent generator of Australian Carbon Credit Units (ACCUs) in Western Australia.

Argonaut continues to support the communities in which it operates, with multi-year commitments to Miners’ Promise and the CoRE Foundation, reflecting its values and long-term vision.

“As our business has grown, so has our capacity to give back meaningfully to the regional and mining areas that we serve,” added Rigg. “I am proud that our contributions have had a tangible positive impact to local communities through our Social Impact program and staff charitable giving which has seen more than 40 individual organisations supported this year.”

YEAR-TO-DATE PERFORMANCE & OUTLOOK

Argonaut’s financial performance in Q1 FY26 has been very strong and is ahead of both budget and the group financial performance at the same period last year. Revenue for Q1 is estimated at $22 million.

Corporate Finance activity continues to drive group financial performance with approximately $730 million raised for clients year to date and a strong and growing transaction pipeline. In addition, agency brokerage and Argonaut’s Fund Management portfolio performance are operating at record levels.

Argonaut’s outlook for FY26 remains strongly positive based on the transaction pipeline and market activity and conditions.